UltraIQ began as a capital allocation tool.

Before committing serious time or money to a blockchain ecosystem, I wanted to answer a simple question: is this network actually being used?

Not talked about, hyped, or promoted.

Used.

UltraIQ is a live on-chain analytics platform built to measure adoption, economic activity, and structural growth across the Ultra (UOS) ecosystem. It tracks wallet creation, contract deployments, treasury flows, bridge activity, EVM usage, and price data - turning raw blockchain state into structured, comparable metrics.

What It Tracks

UltraIQ currently includes:

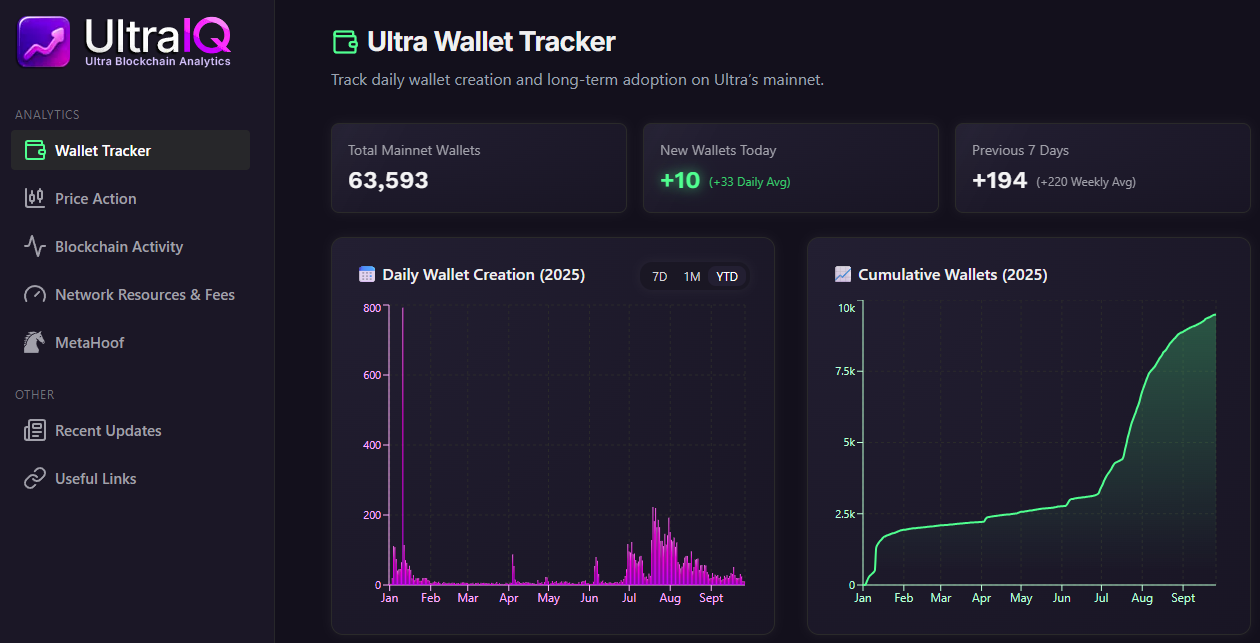

- Wallet Tracker - daily and cumulative wallet growth on mainnet

- Blockchain Activity - contract deployments, upgrades, and action-level trends

- Bridge - cross-chain inflows and outflows

- Ultra EVM - EVM-side activity and interaction tracking

- Treasury - monitored treasury and strategic wallet movements

- Price Action - contextual market reference

Each module is designed to answer a capital question:

Is the network expanding?

Are developers building?

Is value circulating internally?

Are resources being consumed?

Purpose

Ultra’s architecture links token demand to network utility - RAM purchases, POWER staking, marketplace mechanics, and UOS-denominated fees.

If that linkage works, it should show up in the data.

UltraIQ exists to monitor that reflexive loop.

- If wallet growth compounds, that’s visible.

- If contract deployments cluster, that’s visible.

- If treasury flows shift toward exchanges, that’s visible.

- If bridge activity accelerates, that’s visible.

Narratives come and go.

On-chain state persists.

UltraIQ bridges theory and observable blockchain reality.

Architecture

UltraIQ is built as a modular ingestion and analytics system.

Extraction

- Python-based ingestion

- Ultra Hyperion endpoints for historical actions

- Direct RPC calls for contract state, account data, and resource metrics

- Multi-endpoint failover (eosrio and alternative providers)

Transformation

- Custom ETL pipelines using Pandas

- Normalization of action history into structured datasets

- Aggregation into daily and weekly time-series

- Classification logic for contracts and wallet activity

Storage

- Supabase (PostgreSQL) backend

- Dedicated tables such as

contract_activity, treasury tracking tables, and wallet time-series - Materialized views for weekly rollups and historical snapshots

Visualization

- Next.js frontend

- Recharts for time-series and cumulative analysis

- Investor-focused UI design with structured modules rather than raw block explorer views

Automation

- Cron-based scheduled refresh

- PM2 process management

- Automated weekly rollup updates

The system is designed to extend cleanly. New metrics can be layered in without rewriting the core ingestion pipeline.

Who It’s For

- Investors who want to measure usage instead of relying on sentiment

- Builders who want visibility into ecosystem momentum

- Stakeholders watching and monitoring the network

This is not a marketing site.

It is a monitoring system.

Next Phase

Planned extensions include:

- Empires (upcoming web3 game) analytics module

- Decentralized exchange (CLOAK) metrics and liquidity tracking

- Network resource analysis (fees and burn)

- Category tagging for deployers (games, infra, DeFi)

- Social and developer signals - GitHub commits, Discord growth, Twitter activity

- Discord/Twitter alerts

As the ecosystem evolves, the dashboard evolves with it.

Stack: Python, Supabase, Next.js, Recharts, Tailwind

Objective: Measure whether Ultra’s on-chain economy is strengthening in ways that justify long-term capital commitment.